What Is Equity Release And How Does It Work?

So what is equity release exactly? Equity release is a popular option for homeowners in the UK who want to access cash tied up in their property.

It involves taking out a loan that uses your home as collateral, allowing you to access tax-free money from the equity built up in it – whether lump sum or regular payments.

Equity release can be an excellent solution if you need additional financial flexibility during retirement. Still, it is important to weigh all its risks and benefits before making any decisions.

Limited Availability Equity Release Plan Not Available On Comparison Sites

- Equity release at 5.17%.

- Free valuation fee

- No monthly payments unless you prefer interest-only

- Continue to live in your home and retain 100% ownership

- You can still move home as this equity release plan is transferable

Please Enter Your Requirements Below:

Some Key Points To Consider

- Equity release provides access to the capital tied up in your home for those who are 55 and over, allowing them to access tax-free funds.

- There are two primary forms of equity release: lifetime mortgages and home reversion plans, each with benefits and risks.

- With a lifetime mortgage, you can borrow without making monthly repayments as long as you meet the requirements, such as age eligibility and no existing mortgages against the property.

- Home reversion plans allow individuals to sell part or all of their property in exchange for a lump sum cash payment; however, they still retain ownership rights.

- It is important to seek professional advice before taking out an equity release plan, as potential downsides can include reduced inheritance amounts left behind when passing away or creating long-term debt if large sums cannot be repaid early on.

Understanding Equity Release

Equity Release can help homeowners over 55 access cash tied up in their homes through lump-sum and regular payment schemes.

Definition Of Equity Release And How Equity Release Works

Equity release is a financial product available to UK homeowners aged 55 and over, which allows them to access tax-free funds from the value of their home.

Equity release is a form of long-term loan secured against the home, usually repaid on sale when the homeowner passes away or moves into full-time care.

During this time, they remain owners who continue living in their homes whilst receiving released money from equity release sources; no monthly repayments are required.

Equity release is an effective way for eligible homeowners to receive money tax-free.

There are two primary types of equity release: lifetime mortgages (loans secured against the property. And home reversion plans (selling part of the ownership.

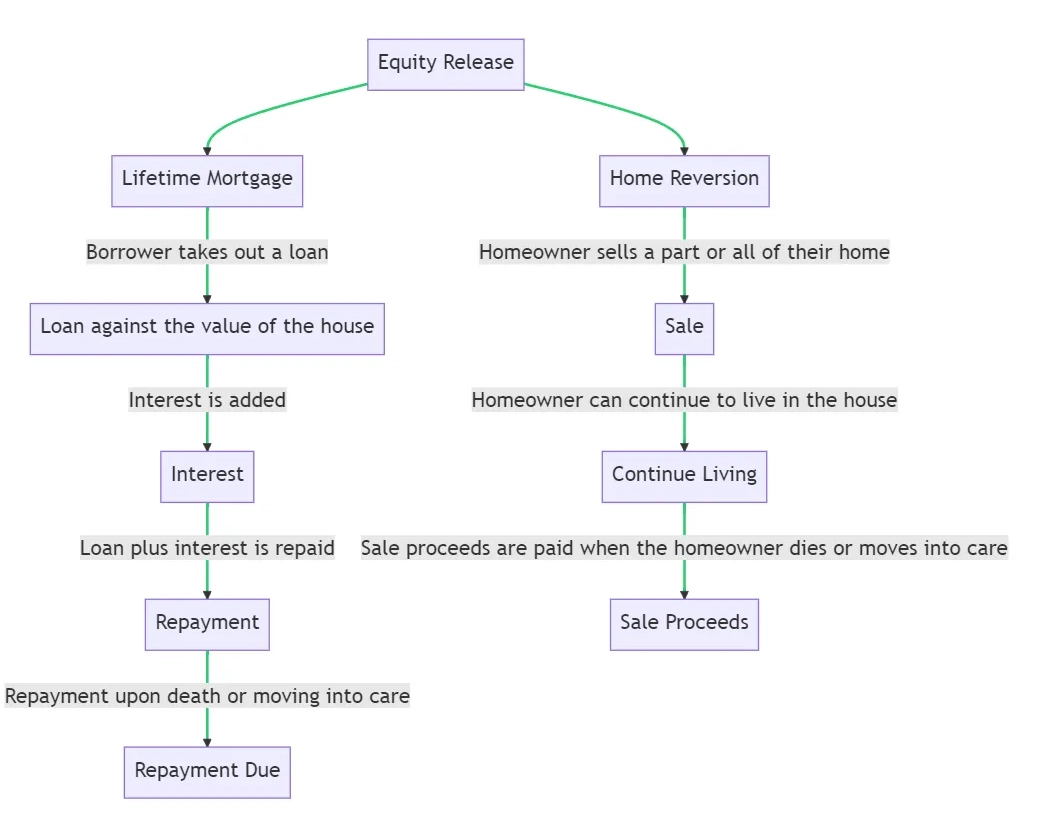

Here is a diagram that explains how equity release works in the UK:

In the UK, there are two main types of equity release: Lifetime Mortgages and Home Reversion Plans.

- Lifetime Mortgage: This is a loan taken out against the value of your house. Interest is added to the loan over time. The loan and interest are repaid when you die or move into care.

- Home Reversion: In this case, you sell part or all of your home to a home reversion company. You can continue to live in the house. The proceeds from the sale are paid when you die or move into care.

Eligibility Criteria

For the UK, eligibility criteria for equity release rests on three main factors: the individual’s age, property values, and any existing mortgages or loans.

As a minimum age requirement, individuals must be aged 55 or over – although some lenders may have higher requirements, such as 60-65 years old – in order to qualify for equity release products.

It is also necessary for them to own their home outright with no outstanding mortgage or loan against it.

The amount of tax-free cash that can be released from one’s property will depend upon their age and the market value of their house; older individuals are typically eligible for larger amounts than those who are younger.

Generally speaking, properties valued at lower than £70k do not qualify.

But if they exceed this threshold, an individual could potentially access more money in equity release schemes by borrowing against their home’s value up to its maximum market resale price (usually up to 40-50%).

For example, if a homeowner owns a property worth £175k that has grown in value since its purchase 25 years ago and they want to access additional income, then they would likely qualify based on current eligibility rules assuming they meet all other conditions.

Types Of Equity Release

Equity release allows property owners aged 55 and over to access the value of their home.

There are two main types – Santander Lifetime Mortgages, which involve taking out a loan secured against your home, and home Reversion plans, which allow you to sell part or all of your property in exchange for tax-free cash lump sum or regular payments.

Regarding eligibility for equity release, homeowners must meet certain criteria, including being at least 55 years old and having sufficient equity in their home that can be released.

The exact amount able to be released is determined by an independent valuation of the property and other factors, such as any existing mortgages on the property.

It is important for homeowners considering equity release options to seek professional advice about these different options before making any commitments.

As with other financial products, equity release has associated risks and potential benefits.

These include reduced inheritance for loved ones (who will not receive any returns from properties upon sale) and access to greater funds during retirement than those provided by pension schemes alone.

This allows individuals to make more informed decisions about later life spending choices such as holidays, home renovations, etc.

Lifetime Mortgages

A lifetime mortgage is a type of equity release that is secured against one’s home and allows homeowners aged 55+ to access the value of their property without having to sell up.

It lets individuals borrow a lump sum or regular payments, with no monthly repayments required during the loan period. For an individual to be eligible, they must age 55 or over, be a UK homeowner, and have enough equity in their property.

The loan can either be repaid when the borrower dies or moves into long-term care, at which point any remaining assets will pay off the interest accumulated over time.

With this type of equity release, there are potential risks such as reduced inheritance for heirs if more money is taken than needed. Interest on outstanding loans can accumulate quickly over a lifetime, depending on market conditions.

Furthermore, if house prices decrease whilst still owing money, it could leave borrowers in negative equity; however, many lenders offer protection in these cases through guarantees such as ‘No Negative Equity’ assurance schemes.

Calculate How Much Tax-Free Cash You Could Release. Please Enter Your Requirements Below:

Home Reversion Plans

Home reversion plans are an option for senior homeowners in the UK to unlock funds from their property, giving them access to cash tax-free and allowing them to continue living in it.

With a home reversion plan, homeowners can sell all or part of their property in exchange for a lump sum and rent-free tenure for life.

Homeowners will receive less money than the market value of their property because the equity release provider is buying at a discounted rate. However, they have no further costs, such as interest payments, unless they decide voluntarily.

The Benefits of taking out a home reversion plan include not having any monthly repayment requirements while retaining ownership rights over your property.

However, risks should be considered before taking out this type of Equity Release product, such as reducing inheritance amounts left behind to family members and possibly creating long-term debt if large sums cannot be repaid early on.

Eligibility criteria include age limitations determined by individual providers (usually 60+), passing stricter financial assessments, which involves obtaining independent legal advice, having sufficient equity remaining after selling your share(s) and meeting lenders conditions regarding existing mortgages put against it.

Other alternative solutions to releasing equity should be considered when considering opting for this form of equity release, such as downsizing or accessing Social Security benefits.

Benefits Of Equity Release

Equity Release can provide several advantages for retired homeowners looking to access financial resources; learn more about these benefits and how Equity Release works.

Accessing Tax-Free Cash

An equity release scheme is one way for homeowners in the UK to access cash tied up in their property.

Through an equity release loan, individuals over 55 years of age can receive a tax-free lump sum or regular payments without the need to make any monthly repayments or relinquish their ownership of the property.

According to individual provider regulations, certain criteria may need to be met to be eligible for an equity release plan. For example, you must ensure that your home meets value requirements and that you are up-to-date with existing mortgage payments.

Additionally, depending on your circumstances, risks may be associated with taking out an Equity Release product, such as being unable to pass on the remaining inheritance due to reduced estate value once interest has been paid off and the initial capital has been repaid upon death.

Creating Financial Flexibility In Retirement

Equity release can provide access to large amounts of cash, allowing retirees to free up funds they may have tied up in their property.

This money can then be used for any number of uses, including reducing or eliminating existing debt, funding home improvements or renovations, and creating a more secure retirement income.

However, it is important to understand the long-term implications of equity release before making a decision; releasing too much of your home’s value could reduce the amount your heirs receive once you pass away.

Therefore, seeking advice from an independent financial advisor before taking out lifetime mortgages or other forms of equity release is advisable.

A qualified financial adviser can discuss the potential benefits and risks associated with seeking retirement income this way and advise if equity release is suitable given individual circumstances.

No Monthly Repayments Required

The most significant benefit of equity release is that it does not have to require any form of monthly repayment.

Those who enter an agreement will receive a lump sum or regular payments depending on the type of product chosen without needing to make repayments until the loan needs to be repaid, usually upon death or when moving into a long-term care home.

Rather than making interest and capital repayments every month as you would with traditional mortgages, your lender charges interest which then rolls up each year as part of the outstanding loan balance.

This means there are no fixed monthly outgoings during the duration of your agreement.

But please note that if you do not fully clear your mortgage with one big payment at the end, it may increase over time due to accumulated interest rates, potentially leaving behind negative equity in your property.

Continued Homeownership

One of the key advantages of equity release is that homeowners can maintain their existing way of life.

Many products offered by Equity Release Council members come with a No Negative Equity guarantee, meaning that individuals will never owe more than what the property is worth.

This safeguard allows those looking to access tax-free cash whilst retaining control over their home—a huge benefit for retirees who may not want or be in a position to move out at such a late stage in life.

Depending on their preference and situation, homeowners can choose from two primary forms of equity release: lifetime mortgages and home reversion plans.

Releasing equity through an arrangement like this means one does not have to downsize homes when retired. Instead, it takes advantage of all the financial benefits of releasing equity while enjoying your current lifestyle.

Providing For Loved Ones

One of the most popular uses of equity release is to leave money behind for relatives or dependents by accessing cash from a home.

With equity release, those over 55s can obtain a lump sum payment or an income stream that can be used during retirement and beyond.

This can mean many things, including leaving funds for their children, grandchildren or other family members at their passing.

From an inheritance point of view, it is essential to consider any tax liabilities associated with this gift through lifetime mortgages- as these have now become applicable under certain circumstances.

When using an equity release product to provide for loved ones, professional financial advice should always be sought to understand what options best suit individual needs and minimise risks.

Risks Of Equity Release

It is important to consider the potential risks associated with equity release; however, understanding these can help you decide about entering into this type of agreement.

Reduced Inheritance For Heirs

Equity release, by taking out a loan secured against the value of your home and property, can impact potential inheritance for those named in beneficiaries.

Inheritance taxes also apply to the release of equity taken from a home. These funds are seen as potentially being gifted away during life, allowing them to pass outside of the inheritance tax band thresholds.

If such gifting occurs more than seven years before death, then there is some chance that gift duty may not become applicable.

But if done too soon, it will likely be subject to 40% taxation along with anything else included in the deceased’s estate, which exceeds current government allowances exempt prices.

Potential Long-Term Interest Accumulation

Equity release offers the opportunity to access tax-free cash, but it comes with associated costs and risks.

One of these is interest accumulation over time; if left unpaid, this can significantly affect the size of the loan balance due at a later stage.

With a lifetime mortgage – one form of equity release – interest will accumulate monthly on the outstanding balance.

This amount will be added to the overall loan amount meaning that you could repay substantially more than initially borrowed when lump sum payments are included.

Understanding this aspect of equity release is important before committing to any plan. An unpaid balance upon death or admission into permanent care may impact any potential inheritance for family members or other beneficiaries down the line.

Possibility Of Negative Equity

Equity Release can come with some associated risks, including the possibility of negative equity. This happens when the outstanding loan amount upon repayment exceeds the current market value of your home.

Therefore, it’s important to consider fluctuations in house prices and economic conditions before committing to an Equity Release product.

It’s also essential to use trusted providers offering a No Negative Equity Guarantee; this guarantees that you will never owe more money than your property is worth.

In addition, making careful decisions on how much to borrow and understanding if other borrowing options may be available should also be considered, as debt should never be entered into lightly at any age or stage of life.

Impact On Eligibility For State Benefits

Taking out equity release can directly affect an individual’s eligibility for certain state benefits such as pension credit, council tax reduction and care funding.

Generally speaking, money received from equity release may reduce the amount of some state benefits that individuals are entitled to.

These means-tested benefits consider all assets, including additional income and capital, available to people over a certain age.

Any decision about Equity Release should be considered carefully, in conjunction with the advice of an independent financial adviser and solicitor.

They will be familiar with pension contract regulations before taking out this type of loan agreement due to its potential impact on state benefit entitlements later in life.

Eligibility For Equity Release

Individuals must meet certain criteria to qualify for equity release, including a minimum age and property value requirement.

Age Limitations

Regarding equity release, age is a major determining factor in terms of eligibility. Most equity release providers require applicants to be aged 55 or over, with some plans only available for those aged 60 and above.

This restriction is based on the premise that homeowners must have reached an advanced stage in life before considering such a big financial commitment.

For example, Lifetime Mortgages usually require their applicants to be no younger than 55 years old and Home Reversion plans tend to set the minimum at 60 years old.

The age requirement might be slightly higher for more complex Equity Release plans, although these are less common than standard options like Lifetime Mortgages or Home Reversions.

Property Valuation Requirements

Property valuation is a key component of the equity release process. The valuation of your home determines how much money you are eligible to receive in tax-free cash, as only an approved amount can be borrowed against its market value.

Understand the factors influencing property valuations and ensure your home meets those criteria.

Location plays a significant role in assessing the value of your property; living close to amenities such as schools, parks, or transport hubs may increase its worthiness compared to less desirable locations with reduced accessibility.

Size is also considered when carrying out appraisals – larger homes typically result in higher figures than smaller residences.

Existing Mortgage Conditions

Homeowners with existing mortgages should consider how their lender may view equity release products, as this can impact their eligibility and the amount of money available.

Generally speaking, lenders expect an outstanding loan to be paid off before a homeowner can use their home equity. The remaining equity can be released as a lump sum or regular payments.

Consider any additional associated costs, such as Early Repayment Charges or set-up fees, which could reduce the cash available for release.

Alternatives To Equity Release

Other options are available to homeowners considering their financial prospects in retirement, such as downsizing, debt management, or using available social security benefits.

Downsizing

Moving to a smaller home is a popular debt-free option for seniors seeking additional funds. Many retirees, particularly those with limited resources, struggle with their finances.

Downsizing usually requires homeowners to move away from the family home they are attached to, which could come at an emotional cost and involve packing up treasured memories and possessions and furniture.

Nevertheless, downsizing is typically cheaper given the reduced running costs and can potentially release cash to help supplement retirement income needs and expenses.

At a practical level, there will be costs associated with selling one’s house.

These include legal fees, mortgage payments owed by the seller, broker’s fees (or moving agent), and any extra expenses related to running two houses during this transition period, food bills or utility charges may also become payable).

The advantages of downsizing include having minimal restrictions compared to equity release schemes, where eligibility criteria must be met before any consideration can be reached regarding borrowing sums against property values, etc.

Debt Management

A practical alternative to equity release is debt management, which involves taking a planned approach to reduce existing debts.

Debt management plans enable individuals in the UK to manage what they owe and ensure that all of their payments are met without having to access more credit or seek expensive solutions such as equity release products.

By consolidating monthly outgoings and renegotiating loan terms with lenders, people in the UK can achieve significant savings on monthly interest charges.

This can improve an individual’s financial situation by dramatically reducing their monthly outgoings, opening up money left over for other uses, including retirement planning where appropriate or paying off existing debts faster than expected.

People considering debt management should also be aware of alternative forms of borrowing that might cost less overall, depending on individual circumstances.

Social Security Benefits

Equity release can affect eligibility for state benefits and the amount a person may be able to receive in means-tested benefits.

For example, where an individual is or becomes eligible for Universal Credit, any amount released through equity release may need to be declared and could reduce the level of support afforded.

Likewise, those receiving Pension Credit or Housing Benefits could find their entitlements drop due to increased capital released via equity release.

It’s also important to note that when taking out a lifetime mortgage (the most popular form of equity release), the monthly payments will increase in interest over time, which may further impact benefit levels.

Choosing An Equity Release Provider

When selecting an equity release provider, it is important to research available options and compare fees to ensure you choose the right product for your needs.

Researching Available Options

When considering equity release, researching options is essential to ensure that the most suitable provider is chosen and the best deal is secured.

Deciding which equity release product is right can be a complex and time-consuming.

Still, it’s important to compare fees, charges and rates from different providers to determine which offers you the best value for money and meets your individual needs.

Individuals seeking information on equity release providers should seek independent legal and financial advice to better understand their options.

Many organisations offer impartial advice, such as the Citizen’s Advice Bureau or Age UK, which have expertise in this area of finance.

- Gather sufficient information about available products by reading reviews, researching providers and asking for advice from regulated independent advisers.

- Determine what type of equity release plan would suit you best based on your situation—a lifetime mortgage or home reversion plan—taking into account features such as interest rates, loan amount, repayment flexibility, early repayment charge, and repayment terms.

- Evaluate fees associated with each particular plan, such as application and initial establishment fees, against any associated benefits or rewards they may provide, such as free valuation or fixed interest rate period.

- Ensure the chosen provider is well-regulated—look for industry accreditations like those provided by Equity Release Council (ERAC)—to guarantee a certain level of security concerning provider conduct.

- Ask detailed questions about key points not clearly explained in provider literature, such as possible implications should you move house later, the guarantee period for terms and conditions, etc.

- Familiarise yourself with the potential pitfalls of taking out an equity release loan, such as reduced inheritance for heirs, negative equity risk due to falling house prices, etc.

- Choose whether a lump sum or regular payments suit your requirements.

Comparing Fees And Charges

Equity release comes with various fees that can significantly impact the overall cost of the product. By carefully comparing these fees across different providers, borrowers can find the best deal that suits their needs.

The following table outlines some common fees and charges associated with equity release:

| Fee/Charge | Description | Typical Cost |

|---|---|---|

| Arrangement Fee | Legal fees are payable to a solicitor who will handle the equity release process and ensure all necessary documentation is completed accurately. | £0 – £695 |

| Valuation Fee | The lender charges a fee for setting up the equity release plan, which may cover administration costs and other expenses. | Variable, depending on property value |

| Solicitor Fees | Legal fees payable to a solicitor to handle the equity release process and ensure all necessary documentation is completed accurately. | Approximately £650 |

| Early Repayment Charge (ERC) | A fee may be charged if the borrower decides to repay the equity release plan before the agreed term ends. This could be a fixed amount or a percentage of the outstanding balance. | Variable, depending on provider and terms |

| Annual Interest Rate | A fee for having the property value to determine how much equity can be released. | Variable, depending on provider and plan |

To compare fees and charges effectively, borrowers should gather quotes from multiple equity release providers and review the details of their offers.

They should consider the arrangement and valuation fees, the interest rate, and any potential early repayment charges. By doing so, borrowers can make an informed decision when selecting an equity release plan that offers the best value for their situation.

Understanding Contractual Agreements

Equity release involves entering into a contract legally binding the consumer to a long-term commitment.

Therefore, people considering equity release must be fully informed of their rights and responsibilities with any contractual agreement before signing up for an equity release plan.

Consumers should always ensure they understand the associated fees, charges and potential impact on inheritance, as well as what level of service they are entitled to from their chosen provider to make an informed decision about entering into such an agreement.

Independent Legal And Financial Advice

Regarding equity release, seeking independent legal and financial advice is strongly advised before deciding.

An experienced advisor can explain the various products available, such as lifetime mortgages or home reversion plans.

When considering equity release, it is recommended that you use an accredited provider, as this gives you peace of mind that professional standards have been met.

Through careful planning and guidance from a qualified professional, homeowners are far more likely to select suitable products that provide the best possible retirement income solution.

The Equity Release Application Process

- Property Valuation

- Financial Assessment

- Legal Requirements

To get started on your equity release application and discover how much money you can access tax-free, leverage our expertise and learn more.

Property Valuation

When considering equity release, homeowners must have their property independently valued to determine how much they can access.

This process involves an expert surveyor conducting a detailed inspection of the property and considering relevant factors, such as its size, location, condition and age.

The home’s value will be based on current market prices and trends in the local area, while any improvements or renovations carried out by previous owners may also affect this figure.

Obtaining a proper valuation is necessary for calculating potential repayments under lifetime mortgages in addition to providing an accurate assessment.

Certain fees will apply for this service, but your chosen provider usually covers these.

Financial Assessment

Equity release is an increasingly popular option for people over 55, allowing them to access tax-free funds from the value of their home.

However, all factors and potential risks must be considered before making any decisions about equity release.

A financial assessment plays a critical role in understanding if equity release suits one’s circumstances and what amount can be released safely.

Depending on the scheme selected, the financial assessment includes elements such as the market value of your property, existing mortgage repayments, and credit history.

This provides insight into whether you wish to take out more than the expected monthly rental charge or go with a lump-sum lifetime mortgage scheme whilst considering current savings and third-party debts that may need deduction upon application approval.

Legal Requirements

Equity release requires individuals to fulfil several legal requirements. When applying for equity release, homeowners should ensure that they understand the terms and conditions associated with the agreement.

When considering one of these products, it is essential to receive independent legal advice.

Valuation requirements may also need to be met, as lenders want proof that an accredited surveyor has established a realistic market value.

This can help limit liability should a homeowner opt for equity release in later life and house prices drop significantly over time.

Additionally, financial assessments must be completed to calculate how much equity a person can borrow against their home – ensuring any proposals are affordable and suitable for personal circumstances.

Aftercare And Support

– Understanding available aftercare options and support services is essential for all equity release customers to enjoy a long-term relationship with their chosen provider.

Ongoing Advice And Support

Opting for equity release is a significant decision, and individuals who have chosen this option should seek ongoing independent advice throughout their plans.

Advice from an independent financial adviser (IFA) and their legal advisor can help ensure that councils, regulations, and lenders are adhered to maintain security over time.

Changes such as rising interest rates or falls in house prices can affect repayments or make it difficult for borrowers to move houses without repaying the loan.

So, staying updated with information on products and markets ensures that consumers receive good value from equity release schemes.

IFAs provide support by monitoring interest rates, dealing with providers if customers experience difficulties making payments or problems arising later in life, which might be solved via changes to the agreement, and recommending alternatives when necessary.

Complaints And Dispute Resolution

Equity release providers in the UK must abide by a Code of Conduct enforced by the Equity Release Council. This means that any complaints or disputes should be resolved internally first and foremost.

Customers of equity release providers have access to The Financial Ombudsman for customers who are not satisfied with the response given by their provider’s own internal dispute resolution process.

If necessary, individuals can take legal action against their provider or seek advice on other remedies, such as court orders.

Independent financial advisers are essential in guiding customers, ensuring they receive competent and impartial advice when entering into an equity release contract.

So they understand all potential risks associated with it; this could help prevent complaints or disputes later on.

What Is Equity Release – implications for 2025

The decision to use equity release should not be taken lightly. It is a significant financial commitment that doesn’t always provide an immediate solution to your money worries but could tie you and your heirs into a long-term arrangement.

Before considering taking out an equity release product, it’s essential to consider all available options and sources of advice, such as downsizing or debt management, to understand the full implications of this type of borrowing.

It also requires careful research into providers and products and full disclosure regarding existing mortgages.

Taking independent legal and financial advice will ensure you make the most appropriate decisions for yourself and your loved ones.

Equity Release Risks

The main equity release risks are the individual’s ability to understand what the real implications are. You could be better off looking at uk property for sale under 100k so you own your home outright and you have the cash from the sale of your home.