Best Secured 10 Year Loans – Fixed Low Rates 2025

In our journey through life, financial planning is a crucial companion. It guides us in making sound decisions and paves the way towards achieving our aspirations.

One such decision may involve secured 10 year loans, a financial product that offers numerous benefits, including potentially lower interest rates and higher borrowing limits. But what exactly are these loans, and how can they serve your financial goals? Let’s delve deeper.

Short Summary

- Secured 10-year loans offer increased borrowing, reduced interest rates and convenient monthly payments.

- Eligibility criteria include providing an asset as collateral, minimum credit score, evidence of income and a positive credit history. Fees such as arrangement fees may also apply.

- Alternatives to secured 10 year loans include personal loans, credit cards and overdrafts.

Access to a broad specialist lender panel with 100’s of secured loan products & high rates of acceptance!

- Our secured loan brokers match the term of the loan to remaining term of your mortgage

- Great for clearing other loans/credit cards/existing car credit

- New lenders for 2025 now available

- High loan-to-value (LTV) with many lenders

- Same day decisions. Quick & simple

- Keep your existing mortgage with no hassles

- Soft footprint credit search that won’t affect your credit rating

- We Offer Homeowner Loans From The UK’s Top Lenders . Flexible Repayments. Exclusive Rates – Secured Loan Brokers

- Rates from just 4.47%

- Borrow up to 100% of the value of your home ( subject to status)

- No obligation to proceed

- We have broker only lenders that are not featured on the far from impartial comparison engine sites.

Pre-Decision In Principle Application Form. Sympathetic To Past Credit Problems: All Forms Of Credit. Prime, Light, & Heavy Adverse Considered.

Understanding Secured 10 Year Loans

As the name suggests, a secured loan is secured by an asset. This asset, often a property or a vehicle, acts as collateral, providing the lender with a safety net in case of default.

This starkly contrasts to unsecured loans, where no collateral is required, making the lending process riskier for the lender. When considering a secured and unsecured loan, it’s essential to understand these key differences.

In this case, the loan term is ten years, which refers to the period over which the loan must be repaid. The longer the loan term, the lower the monthly repayments, but the more interest you’ll pay overall.

The credit score is another vital factor, as it can significantly impact the interest rate, loan amount, and loan terms.

Advantages Of Secured 10 Year Loans

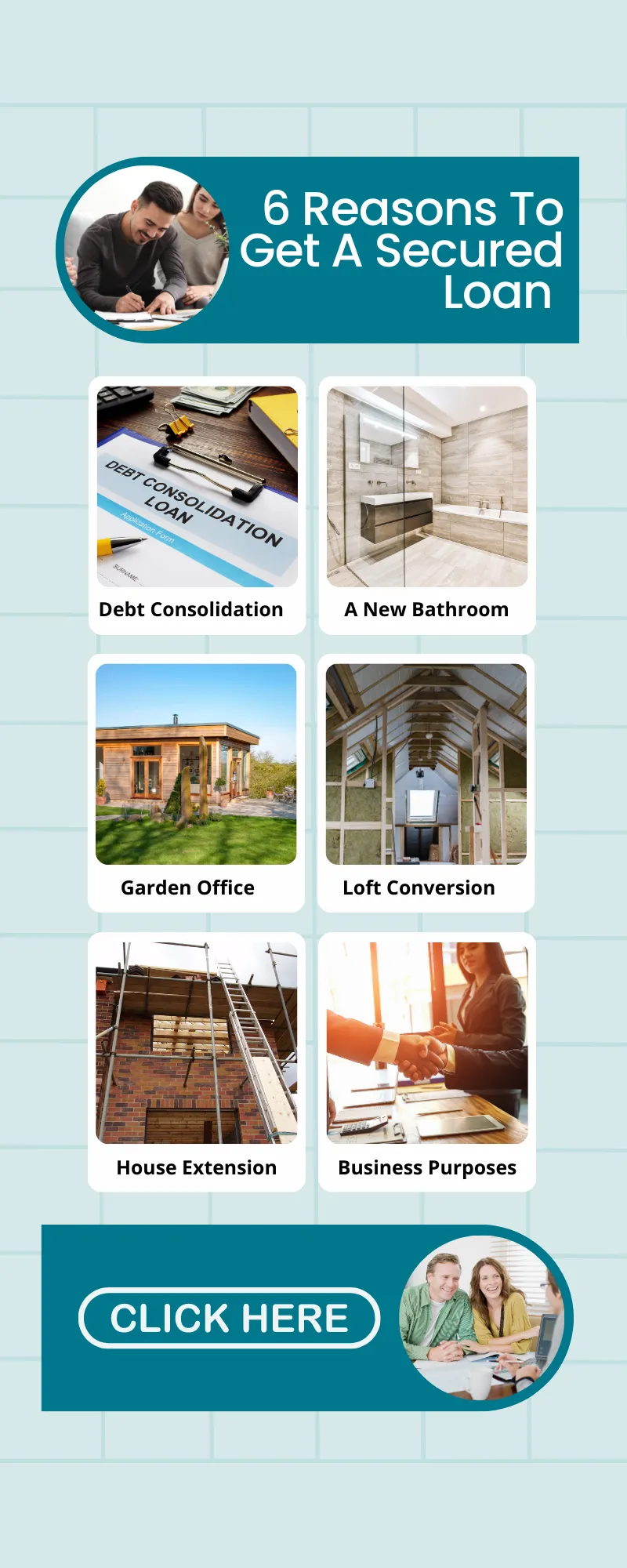

Secured 10-year loans come with several advantages that can attract borrowers. They offer increased borrowing, reduced interest rates, and convenient monthly payments. This is particularly beneficial for those planning a significant expenditure, such as a home renovation or a business expansion.

Furthermore, compared to unsecured loans, secured 10-year loans usually come with lower interest rates. Why? Because the presence of collateral reduces the risk for the lender.

The lender can reclaim the asset and recover their losses in case of default. This security allows the lender to offer more favourable interest rates, making the loan more affordable for the borrower.

Disadvantages Of Secured 10 Year Loans

While secured 10-year loans offer numerous advantages, they have drawbacks. The most significant risk associated with a secured loan is the potential loss of the asset used as collateral if monthly repayments are not met.

If you default on your loan, you risk losing your home or any other asset pledged as collateral. Therefore, it’s crucial to compare secured loans before making a decision.

Moreover, while the lower monthly repayments and extended repayment period may seem attractive, they also mean that you will be in debt for a longer period, and the total amount you pay back may be higher.

Therefore, it’s important to evaluate your financial capability thoroughly before securing a 10-year loan against your assets.

Types Of Secured Loans For A 10-Year Term

Secured loans come in various types, each suitable for different needs and circumstances. Some of the most common types of secured loans for a 10-year term include home equity loans, second mortgages, and business loans.

Each of these loan types uses a specific asset as collateral and has its unique features and benefits.

For instance, home equity loans and second mortgages use your home as collateral. They enable you to tap into the value of your home to secure a loan.

On the other hand, business loans use your business assets as security. They can provide the funds needed to grow your business, purchase equipment, or cover other business-related expenses.

Home Equity Loans

Home equity loans, also known as homeowner loans, allow homeowners to leverage the equity in their homes to access funds. The home acts as collateral, providing the lender with an asset to recover their losses in case of default.

This type of homeowner loan is particularly useful for homeowners who have built up significant home equity.

They are often used for various purposes, such as funding home improvement projects or consolidating debts. By consolidating multiple debts into a single home equity loan, homeowners may be able to manage their debts more efficiently, potentially enjoying lower interest rates and a single, manageable monthly repayment.

Second Mortgages

Second mortgages, like home equity loans, allow homeowners to tap into the equity of their property. They are a separate loan taken out in addition to your first mortgage and are secured against the same property. If you default on your second mortgage, you could risk losing your home.

Second mortgages can be beneficial for financing larger expenses such as home improvements, paying for college tuition, or consolidating debt.

However, they come with risks, including potentially higher interest rates than primary mortgages and the risk of losing your home if you default on the loan. Therefore, it’s crucial to consider your financial situation carefully before taking out a second mortgage.

Business Loans

Business loans are a type of secured loan that uses the assets of the business as security. This can include equipment, inventory, or even the business’s premises. Like other types of secured loans, business loans often offer lower interest rates and more flexible repayment options than unsecured loans, making them a popular choice for businesses looking for financing.

Business loans can provide the funds needed for a variety of business-related expenses. This could include purchasing new equipment, expanding into new markets, or covering day-to-day operating expenses. As with any loan, it’s essential to understand the terms and conditions before applying to ensure it’s the right fit for your business needs.

Pre-Decision In Principle Application Form.

Eligibility Criteria For Secured 10 Year Loans

You’ll need to meet certain criteria to be eligible for a secured 10-year loan. Firstly, you’ll need to own an asset that can be used as collateral. This could be a property for a home equity loan, a second mortgage, or business assets for a business loan.

Other criteria may include a minimum credit score, evidence of income, and a positive credit history. The specifics can vary among lenders, but these are the most common requirements.

It’s also worth noting that the loan process for secured loans can be more complex than for unsecured loans due to the need to appraise the asset used as collateral.

Secured 10 Year Loans And Interest Rates

Interest rates for secured 10-year loans can vary depending on several factors. These include the type of asset, personal finances, and credit score. But generally, you can expect interest rates for secured 10-year loans to range between 3-10%, which will determine the overall secured loans cost.

There are different types of interest rates available for secured 10-year loans. These include fixed rates, where the interest rate remains unchanged throughout the loan term. Variable rates, where the interest rate can fluctuate over time, and short-term fixed rates, where the rate is fixed for an introductory period before switching to a variable rate.

Applying For A Secured 10 Year Loan

Applying for a secured 10-year loan involves several steps. First, you’ll need to gather all the necessary information and documentation. This usually includes personal data and details regarding any existing debts. It’s also essential to check your credit report, as this can impact your eligibility and the interest rates you’re offered.

When applying for a secured 10-year loan, comparing loan offers from different lenders is crucial. This can help you find the most competitive rates and terms for your needs. You can contact a financial adviser or apply online with 1st UK Money for a no-obligation quote.

Secured 10 Year Loans With Bad Credit

Even if you have a poor credit history or a low credit score, it is still possible to be approved for a secured 10-year loan. This is because the loan is backed by collateral, reducing the lender’s risk.

However, it’s important to note that the interest rates offered may be higher, reflecting the increased risk.

For those with bad credit, guarantor loans might be worth considering. A guarantor loan is where a family member or friend agrees to be responsible for the loan repayments if you cannot make them.

This can provide additional security for the lender and may increase your chances of approval for a secured loan with bad credit.

Fees And Charges Associated With Secured 10 Year Loans

When considering a secured 10-year loan, it’s important to know its various associated fees and charges. In addition to the interest charges, there may be broker fees, application fees, valuation fees, and other costs incurred by the borrower or lender.

Some common fees include arrangement fees, which the lender charges for setting up the loan, and early repayment fees, which are charged if you pay off the loan before the end of the term.

There may also be account fees for the upkeep of the loan. These fees can vary greatly, so it’s important to understand all the costs involved before finalising the loan agreement.

Alternatives To Secured 10 Year Loans

Joint Secured 10-year loans are not the only option available when it comes to borrowing money. Depending on your circumstances and needs, you may want to consider alternatives such as personal loans, credit cards, or overdrafts.

Personal loans are often unsecured, meaning they don’t require collateral. A personal loan can be used for various purposes, from consolidating debts to funding home improvements.

Credit cards and overdrafts, while often having higher interest rates, can offer flexibility and may be suitable for short-term or unexpected expenses.

Secured 10 Year Loans Final Thoughts

Secured 10-year loans offer a variety of advantages, including potentially lower interest rates and the ability to borrow larger amounts. However, they also come with risks, such as the potential loss of assets if repayments are not met.

Whether a secured 10-year loan is the right choice for you will depend on your circumstances, financial situation, and long-term goals.

As with any financial decision, it’s important to do your research, understand all the costs involved, and consider all your options before making a decision.

Using a bad credit secured loan, you might be able to buy a boarded up house outright.10 Year Home Owner Loan FAQs

Is it a good idea to get a secured loan?

A secured loan can be beneficial if you need a larger amount of money and have an asset, such as your home, that you can use as collateral. However, there are risks involved which should be carefully considered.

What are the main disadvantages of a secured loan?

The primary disadvantage is potentially losing your property if you default on repayments. Also, due to their long-term nature, the overall interest paid might be higher even with lower rates.

Why is the cost of a secured loan typically lower than the cost of an unsecured loan?

Secured loans often come with lower interest rates because they’re backed by collateral, which reduces the lender’s risk.

What are the risks of secured lending?

The two main risks are the potential loss of collateral in case of default and the possibility for higher overall payment due to extended term length.

How long can a secured loan last?

Secured loans can last five to 35 years, depending on the lender and your credit score. It is advisable to opt for a lender who offers longer loan terms if you have a poor credit score.

What are the advantages of a secured 10-year loan?

Secured 10-year loans offer several advantages, including higher borrowing, lower interest rates and manageable monthly payments.

These benefits make them attractive for those looking to finance a large purchase or consolidate debt.