TSB Secured Loans 5.68% APR Homeowner Loan

Discover whether TSB secured loans are the right fit for your needs in 2024. TSB homeowner loans are not offered on comparison engine websites.

In addition, this loan option does not require fees or in-person valuations of your home, nor does it involve a drawn-out loan application process.

TSB Secured Loans have high rates of acceptance in 2024

- Great for clearing other loans/credit cards/existing car credit

- High loan-to-value (LTV) with TSB

- Same day decisions. Quick & simple

- Keep your existing mortgage

- Soft footprint credit search that doesn’t affect your credit rating

- 5.67% APR fixed for life

- Borrow up to 100% of the value of your home

- Free no obligation quotation

- Get a free automated valuation without delays

Pre-Decision In Principle Application Form. Sympathetic To Past Credit Problems: All Forms Of Credit Considered

Secured loans are popular for homeowners seeking to unlock equity from their properties in the United Kingdom. Here we will compare TSB’s current offerings with those of other lenders, exploring key factors that can affect eligibility and examining the features of their secured homeowner loans in detail.

We’ll explore the specifics of TSB’s secured homeowner loans, examining their features and how they stack up against similar deals from other financial institutions comparing loan-to-value ratios and annual percentage rates across various providers.

Furthermore, we will guide you through assessing additional costs and fees associated with securing second charge products and strategies to minimize extra charges during the application process. We’ll also discuss age requirements and acceptable purposes for using funds obtained through these types of lending products.

Finally, we’ll highlight the importance of online secured loan calculators when making informed decisions about TSB secured loan rates. We’ll also provide tips on preparing for a successful loan application by gathering the necessary documents and improving credit scores beforehand.

TSB Secured Loan Mortgage Interest Rates

If you’re a homeowner in the UK, it’s important to investigate your possibilities when searching for secured loans. One such option is an assured TSB secured loan mortgage interest rate, which offers competitive terms and conditions that could be ideal for borrowers like you.

This section will discuss the key features of a TSB secured homeowner loan and compare it with other lenders offering similar deals.

Key Features of TSB Secured Homeowner Loans

- Competitive Interest Rate: A fixed interest rate of 5.68% makes these loans attractive compared to competitors’ higher rates.

- Flexible Repayment Terms: Borrowers can choose repayment periods ranging from five to thirty years, depending on their financial needs and circumstances.

- Borrowing Limits: With TSB, homeowners can borrow up to £100,000 (subject to eligibility) based on their property value and equity available.

- No Early Repayment Charges: Unlike other lenders who charge penalties for early repayments or overpayments,TSB allows customers flexibility in managing their debt without additional costs.

Comparing TSB with Other Lenders Offering Similar Deals

To ensure you get the best deal possible on your secured loan, comparing offers from different providers before making any decisions is crucial.

Here are some examples of alternative lenders providing comparable products:

- Santander: offers secured loans with interest rates starting from 6.44% for existing mortgage customers.

- Optimum Credit Ltd: provides homeowner loans with fixed and variable rates, depending on the borrower’s preference and circumstances.

- Central Trust Ltd: This lender specialises in secured loans for homeowners, offering competitive interest rates based on individual credit profiles and property values.

Considering all aspects is critical before selecting the loan that best meets your requirements. While TSB’s assured homeowner loan may be an attractive choice for some borrowers, others might find better deals elsewhere by closely comparing various lenders’ offerings.

Overall, TSB secured loan mortgage interest rates offer a competitive and attractive option for homeowners seeking a loan. Moving on, let’s explore the different offers available from Optimum Credit Ltd and other lenders regarding their respective Loan-to-value ratios and Annual Percentage Rates (APRs).

Optimum Credit Ltd & Other Lenders’ Offers

When seeking a secured loan, it’s essential to research different offers from various lenders to guarantee you get the most advantageous deal. In addition to TSB’s homeowner loans, several other reputable lenders in the market offer competitive rates and terms.

Loan-to-value ratios provided by different lenders

LTV is a key element when assessing secured loans since it dictates the proportion of your property’s worth that can be borrowed. –Note: The actual LTV offered may vary depending on individual circumstances and credit history.

Here are some popular UK lenders with their respective maximum LTVs:

- Optimum Credit Ltd: Up to 100%

- Central Trust Ltd: Up to 75%

- West One Secured Loans Limited: Up to 85%

Optimum Credit Ltd and other lenders offer a variety of loan-to-value ratios, making it easier to compare rates across different providers. By assessing additional costs and fees associated with secured loans, customers can better understand the overall cost of their chosen product and develop strategies for minimizing extra charges during the application process.

Assessing Additional Costs & Fees

When considering a secured homeowner loan, it’s essential to understand the impact of additional costs and fees on your overall financial commitment. This section will discuss how arrangement fees can affect your decision between a homeowner loan from TSB or alternatives offered by competitors like Step One Finance Limited or Norton Home Loans.

Breakdown of Common Arrangement Fees in Secured Loans Market

Arrangement fees are charges that lenders apply for setting up and processing your loan application. These fees vary depending on the lender and can significantly influence the total cost of borrowing.

Some common types of arrangement fees include:

- Application fee: A one-time charge paid at the beginning of the application process.

- Valuation fee: This covers the cost of assessing your property’s value as collateral for securing the loan.

- Lender legal fee: Covers any legal work lenders require during mortgage transactions.

- Broker fee: If you use a broker to find a suitable secured homeowner loan, they may charge you a commission based on either a fixed amount or percentage of your total borrowing amount.

To decide which lender offers better value for money, compare their arrangement fees alongside interest rates and other terms. Money Advice Service presents comprehensive information about different types of loans and associated costs to help borrowers choose wisely.

Tips To Minimize Extra Charges During The Application Process

The following strategies can help potential borrowers reduce the impact of additional costs and fees when applying for a secured homeowner loan:

- Shop around: Compare offers from multiple lenders to find the best deal. Don’t forget to factor in arrangement fees, which can significantly affect your overall borrowing cost.

- Negotiate with lenders: Some lenders may be willing to waive or reduce certain fees if you have a strong credit history and meet other eligibility criteria. It’s always worth asking about potential discounts before finalizing your application.

- Avoid brokers if possible: While using a broker can save time and effort, their commission could add extra expense to your loan. Consider researching options independently or seeking advice from free sources like Citizens Advice.

In summary, understanding the role of arrangement fees is crucial when comparing a homeowner loan from TSB with alternatives offered by competitors like Step One Finance Limited or Norton Home Loans. By considering these additional costs alongside interest rates and other terms, borrowers can make more informed decisions about which lender offers better value for money.

It is important to understand the fees and costs associated with secured loan products, as these can majorly impact your overall borrowing cost. Knowing the qualifications needed to get a loan is critical for finding the best terms. Factors affecting your eligibility will be discussed next.

💡When considering a secured homeowner loan, it’s important to understand the impact of additional costs and fees on your overall financial commitment. Arrangement fees can significantly influence the total cost of borrowing, so it’s essential to compare offers from multiple lenders and negotiate with them if possible.

To minimize extra charges during the application process, borrowers should shop around, avoid brokers if possible and seek advice from free sources like Citizens Advice.

Factors Affecting Your Eligibility

When considering applying for a homeowner loan with TSB or any other lender, it’s crucial to understand the key eligibility criteria that could influence your ability to secure this type of financing product. In this section, we will discuss age restrictions, acceptable purposes for using funds obtained through these types of lending products and maximum borrowing limits.

Age Requirements For Securing a Home Equity-Based Financing Product

Different lenders have varying age requirements when it comes to offering secured loans based on home equity. Generally, borrowers need to be at least 18 years old to apply for such a loan. Some providers may impose an age cap, typically no older than 75 years at the time of application or loan maturity.

You must check each lender’s specific age requirements before submitting your application.

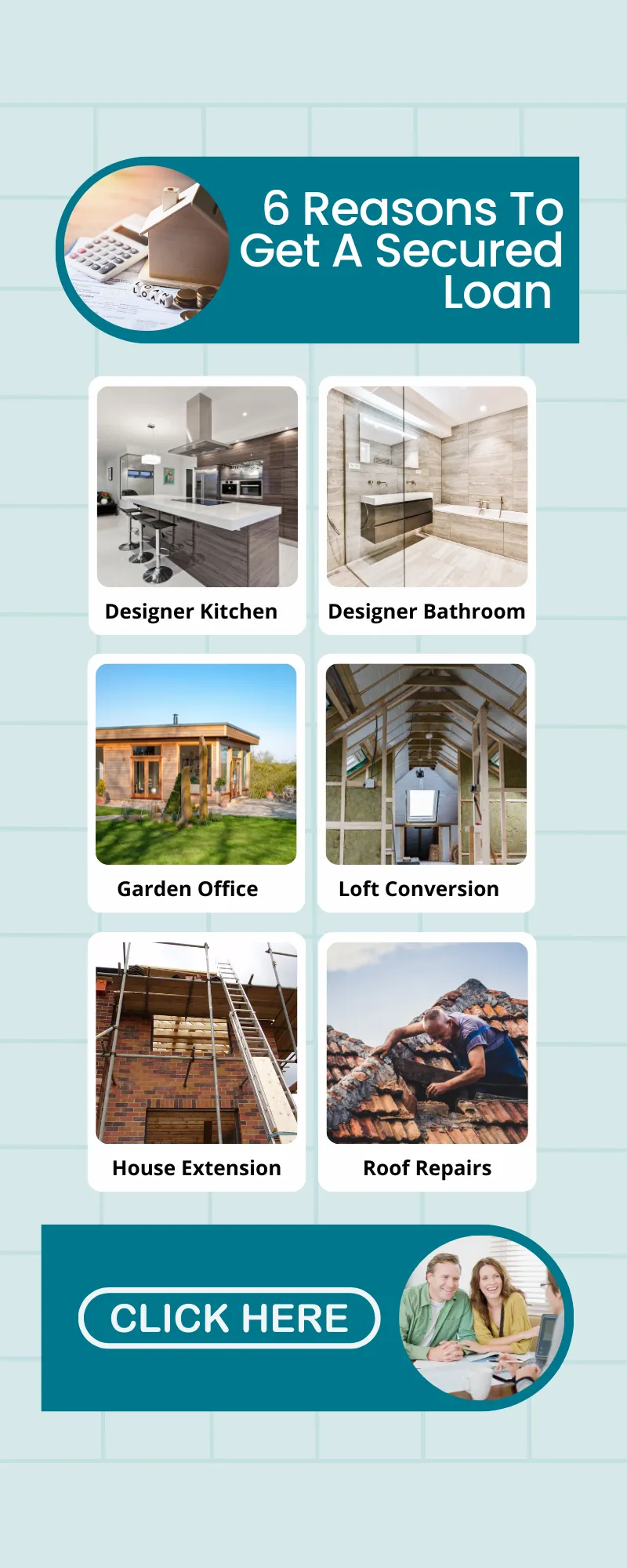

Acceptable Purposes For Using Funds Obtained Through These Types Of Lending Products

- Home improvements: Many homeowners choose secured loans as a means of funding major renovation projects or extensions on their properties.

- Debt consolidation: Borrowers can use secured loans to consolidate multiple high-interest debts into one manageable monthly payment with lower interest rates.

- Bigger purchases: Secured loans can provide necessary funds for significant expenses like buying a new car or paying tuition fees without dipping into savings accounts.

- Bridging finance: In some cases, borrowers might opt for a short-term secured loan to bridge a gap between selling one property and purchasing another.

It’s important to note that lenders may have specific restrictions on the use of funds obtained through secured loans, so it is essential to check their terms and conditions before applying.

Maximum Borrowing Limits

The amount you can borrow with a secured loan is contingent on various elements such as your credit score, income, current debts and the equity held in your home. Lenders will typically offer loans up to a certain percentage of the value of your property – this is known as Loan-to-Value (LTV).

For example, if your home is worth £200,000 and you still owe £100,000 on your mortgage, you have an LTV ratio of 50%. Most lenders offer secured loans at LTV ratios ranging from 60% to 95%, but some might go even higher depending on individual circumstances.

To determine whether or not you meet these eligibility criteria for a homeowner loan with TSB or any other lender offering similar deals like Optimum Credit Ltd or Masthaven. Make sure that you research each provider’s requirements thoroughly before submitting an application.

Knowing the criteria for obtaining a secured loan, such as age and purpose requirements, is key when considering this type of financing. Online secured loan calculators are invaluable for making informed decisions about financing products; they provide users with a comprehensive overview of their options.

💡Before applying for a secured loan, it’s essential to be aware of the eligibility criteria such as age restrictions, acceptable purposes and maximum borrowing limits based on credit score, income and equity.

These include age restrictions, acceptable purposes for using funds obtained through these types of lending products and maximum borrowing limits based on factors such as credit score, income, outstanding debts and equity available in your home.

It is crucial to research each provider’s requirements thoroughly before submitting an application.

Importance Of Online Secured Loan Calculators

Discover how online secured loan calculators can help potential borrowers evaluate their options more effectively while comparing the best interest rates from providers such as Santander, United Trust Bank Secured Loans and TSB. These tools offer a convenient way to assess the affordability of various loan offers based on your financial situation and requirements.

How Online Secured Loan Calculators Work

An online secured loan calculator is a user-friendly tool that allows you to input essential information about your desired loan, such as the amount you wish to borrow, repayment terms, and interest rate.

The calculator then processes this data to estimate monthly repayments and the total cost over the life of the loan. This enables borrowers like yourself to make informed decisions by comparing different lenders’ offerings.

Tips for Using These Tools To Make Informed Decisions

- Be Accurate: When entering information into an online secured loan calculator, ensure that all details are accurate to receive reliable results. For example, double-check figures related to property value or outstanding mortgage balance before submitting them.

- Evaluate Multiple Lenders: Don’t limit yourself by only using one lender’s calculator; instead, use multiple calculators from various providers like Santander or 1st Stop Loans to compare their respective offers accurately.

- Consider Additional Costs: These calculators may not account for additional fees associated with securing a homeowner’s loans (e.g., arrangement fees). Be sure also factor these costs when making comparisons between lenders’ quotes.

- Experiment with Different Scenarios: Utilize the calculator to explore various scenarios by adjusting loan amounts, repayment terms, and interest rates. By adjusting loan amounts, repayment terms and interest rates with the calculator, you can find the most advantageous combination for your financial situation.

Incorporating online secured loan calculators into your research process is a smart way to ensure you’re making well-informed decisions when comparing TSB’s homeowner loans with alternative offers from other lenders. By leveraging these resources, you can be better prepared to secure the most beneficial arrangement for your needs.

The significance of utilising protected loan number crunchers on the web can’t be exaggerated, as they are a great asset for guaranteeing you the most ideal arrangement. With this in mind, it is important to prepare thoroughly before applying by gathering all necessary documents and working on improving credit scores.

💡Online secured loan calculators are a useful tool for potential borrowers to evaluate their options and compare interest rates from different providers like Santander, Optimum Credit Ltd, and TSB.

Accuracy is crucial when inputting information into the calculator, and it’s important to consider additional costs associated with securing homeowner loans while experimenting with different scenarios to find the best deal possible.

Preparing For A Successful Loan Application

Approval for a homeowner loan from TSB or other lenders requires thorough preparation and meeting all eligibility requirements. In this section, we will discuss the necessary documentation you need to gather and strategies to improve your credit score before submitting your application.

Documents needed when applying for a secured home equity-based financing product

To ensure a smooth application process, it’s essential to have all required documents ready before approaching any lender. These typically include:

- Proof of identity: Valid passport or driving license as proof of identification.

- Proof of address: Recent utility bills or bank statements confirming your current residential address.

- Mortgage statement: Your most recent mortgage statement showing outstanding balance and payment history.

- Income verification: Payslips, tax returns, or bank statements demonstrating consistent income over the past few months.

- Credit report: Obtain a copy of your credit report from a major UK credit reference agency such as Experian, Equifax, or TransUnion (formerly Callcredit).

Strategies to improve credit scores before submitting applications

A higher credit score can significantly increase your chances of securing better loan terms with lower interest rates.

Here are some tips on how you can boost your rating before applying for a homeowner loan with TSB or another lender:

- Prompt bill payments: Maintain timely payments on all existing debts like mortgages, loans and utilities since late payments negatively impact your overall score.

- Reduce outstanding debt: Lowering your credit utilization ratio by paying off existing debts can improve your credit score. Aim to keep the ratio below 30%.

- Avoid multiple applications: Making several loan or credit card applications within a short period may lower your rating, as it indicates financial distress. Space out any new applications.

- Check for errors: Regularly review your credit report and dispute any inaccuracies affecting your score negatively.

These steps will increase the likelihood of securing a homeowner loan from TSB or other lenders and help you obtain more favourable terms on future borrowing endeavours.

Property values in the UK vary a lot, and properties to buy Durham can represent excellent value for money.

💡To increase your chances of getting a homeowner loan from TSB or other lenders, you need to prepare thoroughly and meet all eligibility requirements.

This includes gathering necessary documentation such as proof of identity, address, mortgage statement, income verification and credit report.

To improve your credit score before submitting the application, pay bills on time, reduce outstanding debt and avoid multiple applications while checking for errors in your credit report regularly.

Frequently Asked Questions Tsb Secured Loan Rates

What is the current interest rate at TSB?

The current interest rates at TSB vary depending on the type of loan and term. For secured homeowner loans, rates typically start from 5.68%. However, it’s essential to check their official website for updated information, as these rates may change over time.

What is the interest rate on a secured loan?

The interest rate on a secured loan depends on factors such as your credit score, loan amount, and the repayment period. Generally, they range between 5% and 15%, with lower rates available for borrowers with excellent credit histories. To compare offers from various lenders, visit comparison websites like MoneySuperMarket.

Is TSB increasing interest rates?

TSB periodically reviews its interest rates based on market conditions and other factors. It’s important to stay informed about changes by visiting their news releases page. Additionally, you can contact your local branch or speak with an advisor for updates regarding specific products.

What is the TSB fixed-interest rate for 1 year?

A one-year fixed-rate product isn’t commonly offered in the context of secured loans; however, you can find short-term fixed-rate mortgages provided by TSB that cater to different needs. Visit their fixed-rate mortgage page to explore options suitable for your requirements.

TSB Secured Loans Final Thoughts

Overall, TSB offers competitive secured loan interest rates for homeowners in the UK. When assessing the various options, looking into loan-to-value ratios, annual percentage rates, and any extra charges like arrangement fees is crucial.

To prepare for a successful application, applicants should gather the necessary documents and work on improving their credit score beforehand. Additionally, utilising online secured loan calculators can help borrowers make informed decisions about financing options.

If you’re interested in further exploring TSB Secured Loan Rates or other home equity-based financing products, contact 1st UK Mortgages to speak with an experienced advisor.

TSB Contact And Regulatory Details:

TSB Bank plc. Registered office: Henry Duncan House, 120 George Street, Edinburgh EH2 4LH.

Registered in Scotland, number: SC95237.

Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registration number: 191240

Existing loan queries:

0800 111 4166 (UK)

Monday to Friday, 8 am to 6 pm.

New loan queries:

0345 835 3861(UK)

Monday to Friday, 8 am to 6 pm.